Total proved reserves: 33 MM BOE

Proved reserves by commodity: 72% gas…26% oil…2% NGL

States: Texas, Louisiana, Utah, Colorado

Net leasehold acres: 134,000

Well count: 343

BOEPD: 5,250 (74% gas)

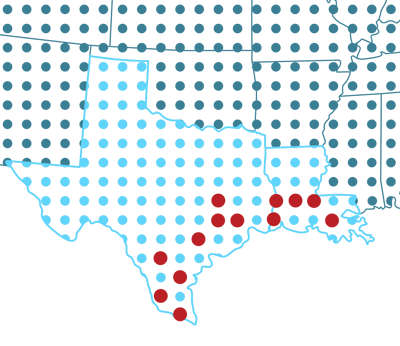

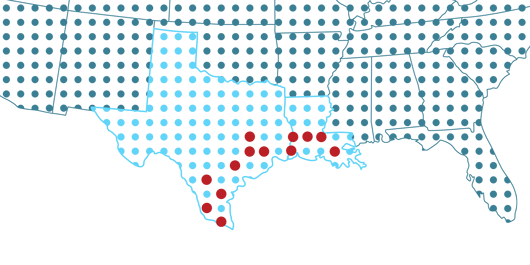

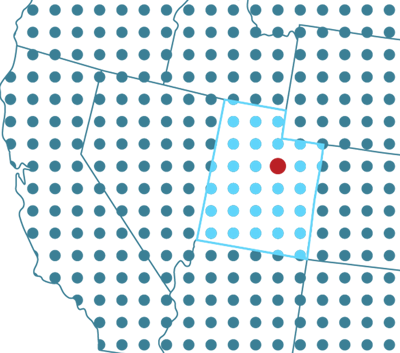

Gulf Coast

16 counties (TX), 16 parishes (LA)

Producing wells: 142

Net acres: 57,000

Proved reserves: 25.9 MM BOE

Mostly vertical, conventional, long-life, low-decline gas-weighted assets and associated production facilities in southern Texas and Louisiana. Assets across the Austin Chalk, Wilcox and Tuscaloosa trends with significant low-risk development inventory.

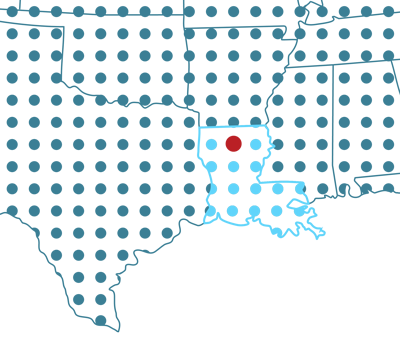

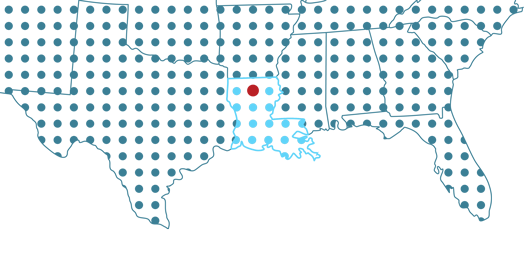

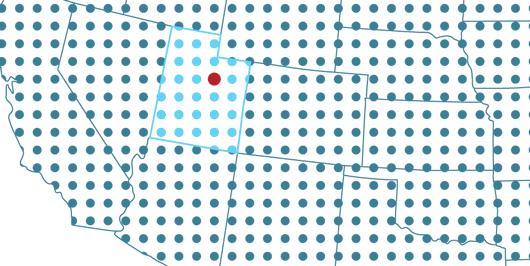

Ark-La-Tex

Caddo, Claiborne, Webster Parishes LA

Producing wells: 30

Net acres: 14,000

Proved reserves: 1.4 MM BOE

Low-geologic-risk assets in northern Louisiana with shallow annual declines. Includes rights to Haynesville, Cotton Valley, and Smackover formations with upside in incremental drilling and development. Midstream infrastructure with 2-pipeline gas gathering system, compression stations, and field office.

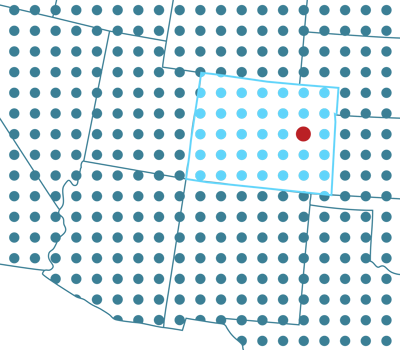

Paradox Basin

Carbon and Emery Counties UT

Producing wells: 156

Net acres: 47,000

Proved reserves: 4.7 MM BOE

Coalbed methane assets characterized as conventional, long-lived, shallow-declining wells with shallow target depths and low drilling costs. Assets 100% held by production situated in Utah’s largest natural gas field, Drunkards Wash, along western edge of Uinta Basin. Includes extensive gas gathering and processing system.

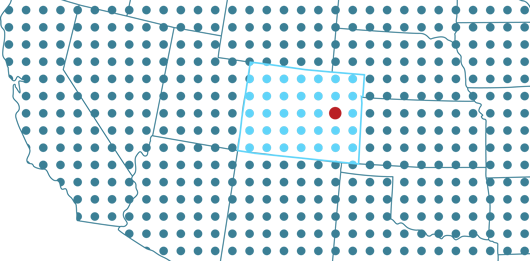

DJ Basin

Lincoln County CO

Producing wells: 15

Net acres: 16,000

Proved reserves: 1.2 MM BOE

Vertical, low-decline, oil-weighted assets and associated production facilities in Colorado’s oil-rich Denver-Julesburg (“DJ”) Basin.